The 150-hour Requirement

If you want to sit for the Uniform CPA Exam in the state of Ohio, you are required to have 150 semester hours (225 quarter hours) of college education. Let's look into this requirement in more detail, considering the value in the credential and what makes sense for the future of the profession.

OSCPA supports the reputation of its members and the CPA credential by:

• Providing greater access to the CPA as an opportunity profession, while maintaining the rigor of requirements for the credential

• Demonstrating that the CPA profession protects the public interest.

CPA Evolution

The AICPA Governing Council and the NASBA Board of Directors both voted in 2020 to support advancing the CPA Evolution initiative.

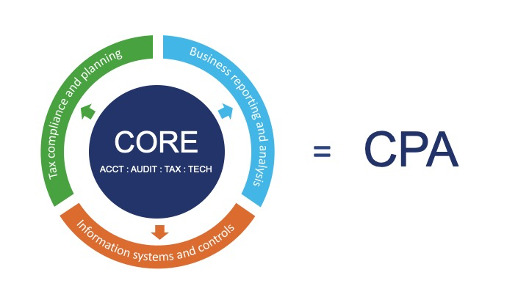

The CPA Evolution initiative aims to transform the CPA licensure model to recognize the exponential growth in skills required for the profession to be relevant for the future. CPA Evolution adopts a core + discipline model, with a strong common core for all CPAs in accounting, auditing, tax and technology. But in recognition of the breadth of knowledge CPAs now need to have, candidates would select one discipline in which to demonstrate deeper skills and knowledge

o Business reporting and analysis

o Information systems and controls, or

o Tax compliance and planning.

Regardless of the discipline selected, all CPAs would retain the same full rights as any other CPA. CPA candidates may select only one discipline for examination. The plan is to launch a new CPA Exam by January 2024.

More than 3,000 constituents, including the OSCPA executive board, commented on the draft CPA Evolution proposal. The final version was responsive to comments calling for a strong, common core, that enhanced skills should not just be about technology, and requests for details about implementing the disciplines. Learn more at https://www.evolutionofcpa.org/.

Education and Experience Requirements

CPA Evolution illustrates that the profession’s current singular path is still not sufficiently preparing candidates for all the future demands of the CPA profession. OSCPA leadership is currently participating in a task force of the AICPA Center for Audit Quality examining the requirements for the final 30 hours of education to obtain the CPA.

While 150 hours of education for licensure is not in question, candidates and employers are pressing for options that are more affordable and accessible, and that better prepare the talent pool for the type of work the profession needs. This initiative is responsive to what we’re hearing from members that they are developing in new areas and that there need to be additive gains beyond the traditional academic approach.

Some of the gains may be addressed in practical experience, and others through enhanced approaches such as OSCPA’s workforce development program.

120/150

In Ohio, OSCPA’s members – particularly our young professionals and students - spoke, and we listened, supporting legislation to provide CPA candidates the option to start taking the CPA Exam when they have 120 semester hours of college education, rather than wait months or even years longer. With passage of the legislation, Ohio would join the 37 other states that already allow CPA candidates to sit for the CPA Exam with 120 hours of education.

Current law in all 50 states requires candidates to complete 150 semester hours of college education prior to licensure, passage of the same national exam, and at least a year of experience. It is important that Ohio maintain those requirements to ensure Ohio CPAs continue to have ease of interstate mobility and avoid multistate licensure.

OSCPA studied this issue at length. In 2017, our board formed a task force of educators and CPA employers; the consensus of this group was they could support sitting at 120, but we needed to keep 150 for licensure. A subsequent deep dive in 2018-2019 by OSCPA’s Young CPA Board found very strong support for the proposed law changes.

This group of young professionals – those already licensed CPAs and those working to pass the Exam - took up this issue in response to the frustration shared by their peers around the state. Their research affirmed that the public interest would not be negatively impacted by allowing students the flexibility of starting the CPA Exam testing process while they are still in school.

They identified several factors that support the law change, but among the most important are mitigating the economic impact of college costs by enabling students flexibility to be licensed faster, and completing exam parts while students are still in a “study mindset” after completing relevant courses of study, and before they start working full time and focusing on a specialized area such as tax or attest services.

These factors are even more critical for nontraditional students and underserved and underrepresented populations. While accounting degree enrollments are high, AICPA’s 2019 Trends report shows that the number of candidates sitting for the CPA exam has continued to decline after the most recent examination revision (7% drop in the 2019 Trends report).

The proposed scenario offers more choice and flexibility: candidates can arrange work, education and sitting for the exam into what works best for their circumstances.

What can I do to help pass this proposed law change?

The best thing you can do is get involved in the legislative process by contacting your state representative and state senator with your thoughts. OSCPA is here to help you with that by providing contact information, talking points, and guidance on how best to get your message out.

Please contact OSCPA’s government relations team for more information at government@ohiocpa.com. Or click here to take action now and send a message to your state senator.