Beware of these cryptocurrency money laundering risks

(Priscilla Du Preez / unsplash)

The rise in popularity of cryptocurrency attracts more than the hopeful investor. Criminals on the lookout for new ways to swindle and camouflage tell-tale money trails have turned to crypto to launder dirty funds or scam the inexperienced and unsuspecting. Stay in the know so your organization and clients don’t get hoodwinked.

Shifty sources

It’s imperative to find the source of funds for trading cryptocurrency. Investigate what the business does, how it makes money and its location. Look for virtual asset amounts and activities that don’t make financial sense and go to or from suspicious sources.

One such suspicious source is virtual asset service providers operating in territories with weak or non-existent anti-money laundering or anti-funding of terrorism regulations. Clients receiving and sending virtual assets to and from these jurisdictions, especially without a business or personal address that would warrant such transactions, could be up to no good or unknowing participants in a scheme.

Money laundering probability is high in platforms without identification validation and transaction history records, so investigate the crypto exchanges in use.

A group of people can link several banks and credit cards in a single crypto wallet to move funds around. Watch for an influx of activity within a small-time frame followed by a long period of no activity.

Peculiar patterns

If the transaction size is a huge lump sum, that could indicate an ill-gotten gain. However, criminals are becoming aware of the amount that triggers an investigation and might switch to erring on the side of caution with more frequent, smaller amounts, so also look for lots of activity followed by lulls.

Other virtual asset transaction patterns that should raise a red flag:

Transfers from multiple people in one account without a commercial explanation.

Depositing virtual assets and immediately withdrawing without logical explanation.

A sizable initial deposit does not fit the client’s or their business’s profile.

All or a portion of virtual assets are traded within 24 hours.

Incoming small transactions that are from many unrelated wallets with ensuing transfers to another wallet or fully traded for fiat currency.

Large amounts of virtual assets are converted to other types of virtual assets or fiat currency without business explanation.

Geographical risks

Money launderers target locations with lesser regulations. Legitimate traders must avoid these areas with a lack of preventive measures and the absence of regulatory bodies.

Anonymity features

Criminals conceal themselves and their funds through technological features that increase anonymity and hamper the detection of corrupt activities. However, these measures are also used for legitimate reasons when investors want more protection and security against theft.

The following are a few features and methods to be on the lookout for:

The client has multiple anonymity-enhanced cryptos (AEC) or privacy coins.

Virtual assets are moved from a public, transparent blockchain to a centralized one and then almost immediately traded for privacy coin or AEC.

Mixing and tumbling services are being used.

Internet domain names are hidden; proxies or registrars suppress or conceal information.

Various encrypted communication means are employed.

Accountants must be aware of these risks to design the best practices to prevent them, such as keeping a watchful eye on the account for other signs and filing a suspicious transaction report (STR) to the proper authorities.

Accountants to the rescue

Asset managers and accountants play a critical role in preventing con artists from entering local and global financial systems. Until information catches up with the fast-paced rate of crypto, financial professionals can lead the way to protect consumers, institutions and the whole economy.

Your insight into a client's or organization's financials and knowledge of little but meaningful tips-of-the-hand by malefactors can mean the difference between a corporate takeover or a criminal take-down.

Accountant by day, superhero by … also by day.

Staying current on best practices for onboarding new clientele and staying up to date on the revealing signs of criminal misbehavior in the digital assets market will allow you to detect and prevent risks for yourself, your clients and your organization.

Do your due diligence

Learning as much as you can about a business or customer is half the battle. Know your business/Know your customer (KYB/KYC) is the current best practice policy. Verify that the client or asset exchange is legitimate and legal. By law, you must screen clients and businesses for sanctions. In addition:

Collect information on parent and intermediary companies.

Access public records to assess risks.

Monitor transactions over time, especially within the blockchain, as one red flag doesn’t constitute fraud.

Conduct a media screening to look for negative news about new clientele.

Helpful regulations

The Anti-Money Laundering Act of 2020 requires that the Bank Secrecy Act now applies to digital currencies. Crypto exchanges must now follow the same rules as other money service businesses, such as the travel rule, Cash Threshold Reporting, Customer Due Diligence and Suspicious Activity Reports.

Unfortunately, even though regulations exist, money laundering and other risks are still present in cryptocurrency. Currently, there is no determination on how regulators will apply and enforce compliance. Additionally, crypto exchanges/ATMs and financial compliance officials have little comprehension of one another. Plus, there is no incentive for crypto operators to report fraudulent practices. As a result, trends and misdeeds go unnoticed

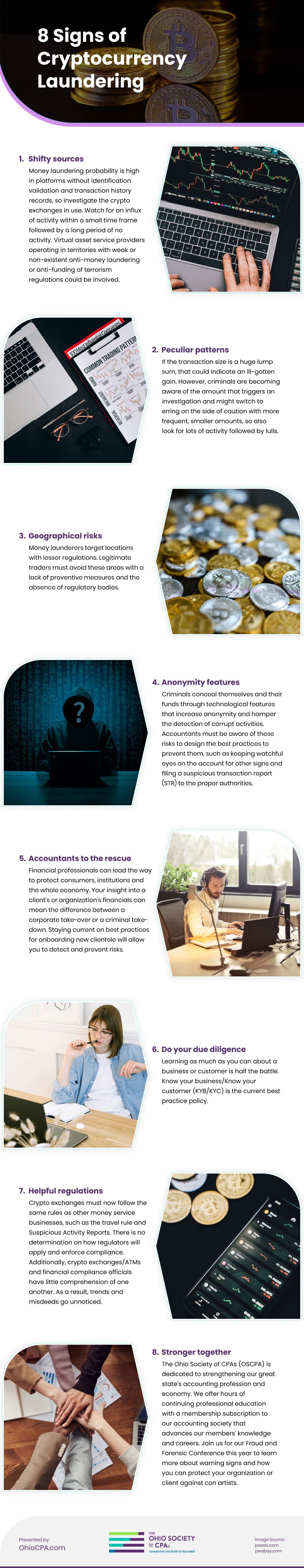

Infographic

Are you thinking and planning to get into cryptocurrency as a new investor? There are some important things you should know about cryptocurrency money laundering risks. Knowing these will surely save you from criminals who are looking to target inexperienced and unsuspecting traders while laundering dirty funds. Read through this infographic and arm yourself with the knowledge to keep yourself safe from these types of people.