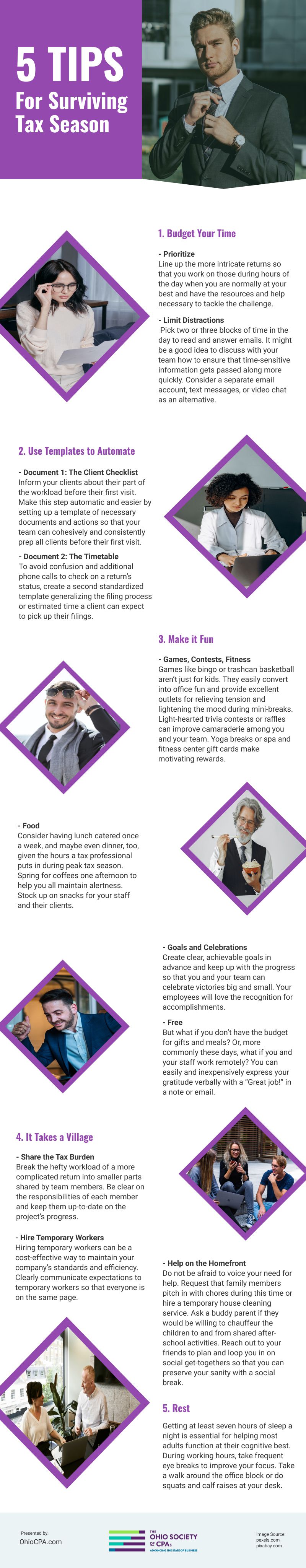

Tax Attorneys: 5 Tips for Surviving Tax Season

(StockSnap / pixabay)

(StockSnap / pixabay)

The busiest season of a tax professional’s year is upon us once again. There’s a lot riding on this, especially when you know that your firm could end up earning half (if not more) of your yearly income during the four months leading up to the April filing deadline. While we know you are head down, nose to the grindstone, working as diligently as you can for your clients, we hope you take some time to read over our five quick tips that can make all the difference for you and your tax professional team this season.

Budget Your Time

PrioritizeSet time aside daily to look at the big picture pertaining to your schedule. Line up the more intricate returns so that you work on those during hours of the day when you are normally at your best and have the resources and help necessary to tackle the challenge. Nestle simpler returns in between the complex to give yourself a break while still maximizing efficiency.

Limit DistractionsReading through emails can lead to hours spent on matters of lesser importance. During tax season, it is critical to minimize distractions. Pick two or three blocks of time in the day to read and answer emails. It might be a good idea to discuss with your team how to ensure that time-sensitive information gets passed along more quickly. Consider a separate email account, text messages, or video chat as an alternative.

Use Templates to Automate

Document 1: The Client ChecklistNeither you nor your client like to leave a tax return hanging in the balance. That can add some extra, unnecessary stress for both of you. To avoid this situation as much as possible, inform your clients about their part of the workload before their first visit. Make this step automatic and easier by setting up a template of necessary documents and actions so that your team can cohesively and consistently prep all clients before their first visit.

Document 2: The TimetableTo avoid confusion and additional phone calls to check on a return’s status, create a second standardized template generalizing the filing process or estimated time a client can expect to pick up their filings. This timetable can be sent to the client ahead of time or handed to them during the exchange of tax documents.

Make it Fun

Games, Contests, FitnessYour 60+ hour weeks may leave you feeling more machine than human, so combat that by interspersing some fun when and where you can. Peppering variety throughout your long days does double duty by improving office morale and increasing creativity and problem-solving skills. Games like bingo or trashcan basketball aren’t just for kids. They easily convert into office fun and provide excellent outlets for relieving tension and lightening the mood during mini-breaks. Light-hearted trivia contests or raffles can improve camaraderie among you and your team. Yoga breaks or spa and fitness center gift cards make motivating rewards.

FoodMeet your team’s basic needs by ensuring they have food and snacks to get them through. Consider having lunch catered once a week, and maybe even dinner, too, given the hours a tax professional puts in during peak tax season. Carve out a chunk of time to eat with one another. Enjoying a meal together improves interpersonal relationships, an excellent benefit for any work team. Spring for coffees one afternoon to help you all maintain alertness. Stock up on snacks for your staff and their clients. Offer a mixture of healthy fare for their personal well-being (you need a healthy team that can avoid brain fog and sickness) and a few unhealthy snacks just for fun. If you have the budget, but this type of planning isn’t your forte, consider hiring a team to execute this for you.

Goals and CelebrationsSet and celebrate goals to inspire your workforce and increase productivity. Create clear, achievable goals in advance and keep up with the progress so that you and your team can celebrate victories big and small. Setting goals and remembering to celebrate those achievements will help you avoid being swallowed up in the seemingly unending mountain of work you have. Your employees will love the recognition for accomplishments. Don’t forget to celebrate yourself for all of your achievements.

FreeBut what if you don’t have the budget for gifts and meals? Or, more commonly these days, what if you and your staff work remotely? You can easily and inexpensively express your gratitude verbally with a “Great job!” in a note or email. This simple gesture costs nothing but makes your team feel highly valued, especially if you individually recognize them with a specific goal they reached or helped achieve.

It Takes a Village

Share the Tax BurdenBreak the hefty workload of a more complicated return into smaller parts shared by team members. Be clear on the responsibilities of each member and keep them up-to-date on the project’s progress so that teammates can effectively manage their individual schedules.

Hire Temporary WorkersSpeaking of “sharing the load,” sometimes the increased work generated during tax season is too much for you and your team to effectively take on without the extra help. Hiring temporary workers can be a cost-effective way to maintain your company’s standards and efficiency. Clearly communicate expectations to temporary workers so that everyone is on the same page. A shared assignment sheet can help make the transition more seamless.

Help on the HomefrontWith all the extra hours you’re putting in, something has to give somewhere. You cannot hope to maintain all of the additional responsibilities on your shoulders outside of work. Do not be afraid to voice your need for help. Request that family members pitch in with chores during this time or hire a temporary house cleaning service. Ask a buddy parent if they would be willing to chauffeur the children to and from shared after-school activities. Reach out to your friends to plan and loop you in on social get-togethers so that you can preserve your sanity with a social break. Get help with meal prep. Develop your “village” in a way that best suits you.

Rest

Last but not least, do not underestimate the power of rest. Getting at least seven hours of sleep a night is essential for helping most adults function at their cognitive best. During working hours, take frequent eye breaks to improve your focus. Use those eye breaks to play games listed in Tip #4, or better yet, add in a burst of exercise to further improve cognition and focus. Take a walk around the office block or do squats and calf raises at your desk. As little as seven minutes of brisk exercise that slightly elevates your heart rate is enough to reduce stress and anxiety and improve concentration.

Reflect

After you’ve survived the busiest part of your year, take some time to breathe deeply and then immediately reflect on what went well and what improvements you would like to see next year while all is still fresh in your mind. Go back through our tips and determine what documents you want to create, what goals you can set for the next round, how you can divide the workload better, and how you can best allocate the best parts of your days and resources. Make plans to use your downtime in the slower months to take online Ohio CPE courses to grow your knowledge. Your planning today will improve your tax season next year!

Infographic

The busiest season for tax professionals is coming. The months leading to April, which is the filing deadline for taxes, are a tricky time since the yearly income of your firm can increase by two-fold or even more. Do you want to know how you can make a difference for your team this coming tax season? Read on for these helpful tips.